Energy Efficient Windows Rebate 2018

Some examples may include.

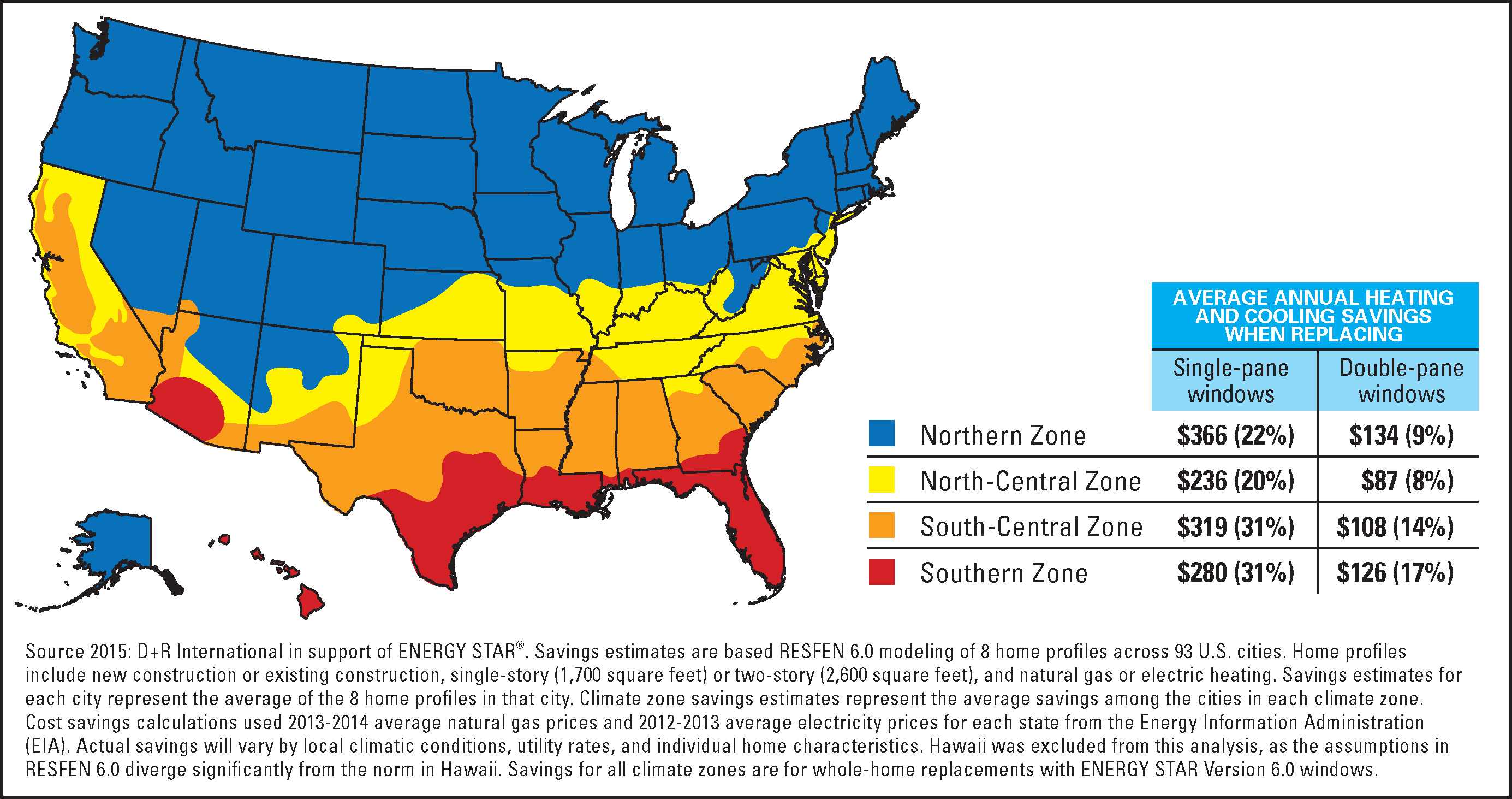

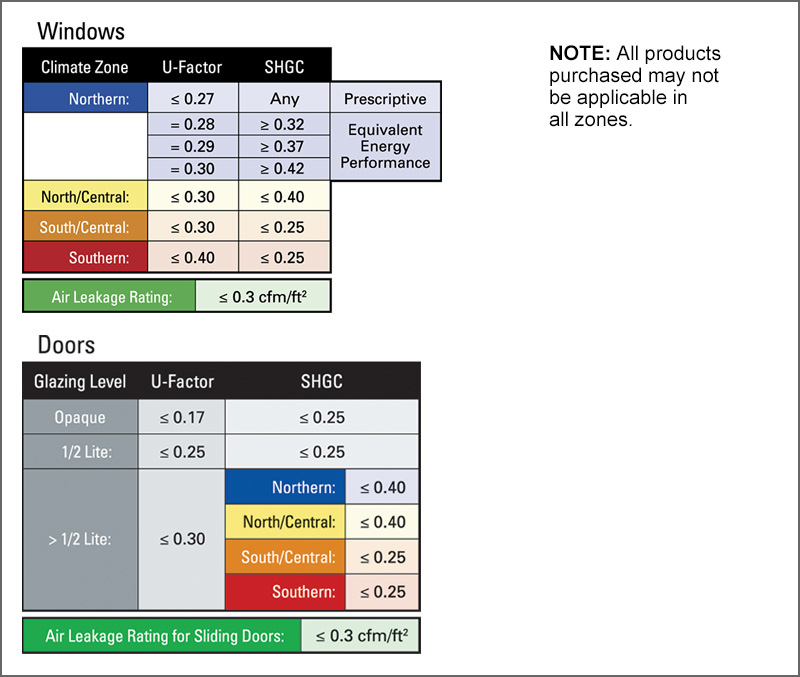

Energy efficient windows rebate 2018. The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through december 31 2020. Purchase and install qualifying windows or patio doors that meet energy star windows program version 6 0 performance requirements beginning january 1 2018 through december 31 2020 save your sales receipt a copy of the manufacturer s certification statement and product performance nfrc ratings energy star qualification sheet with your. Applications must be received by december 31 2020 to qualify for incentive levels advertised on this rebate chart. The first part of this credit was worth 10 of the cost of qualified energy saving equipment or items added to a taxpayer s main home in the past year.

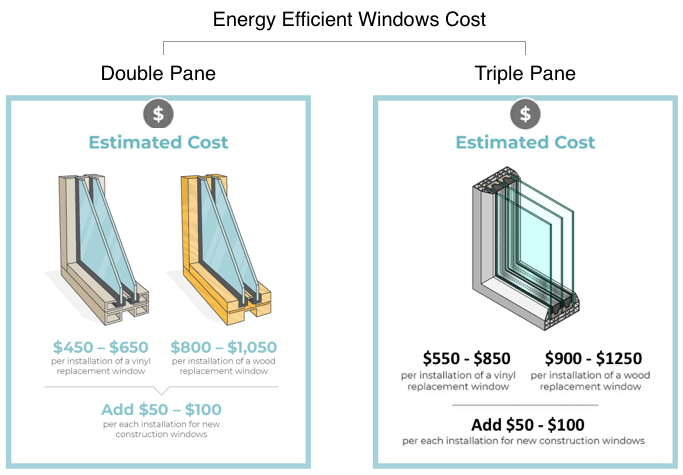

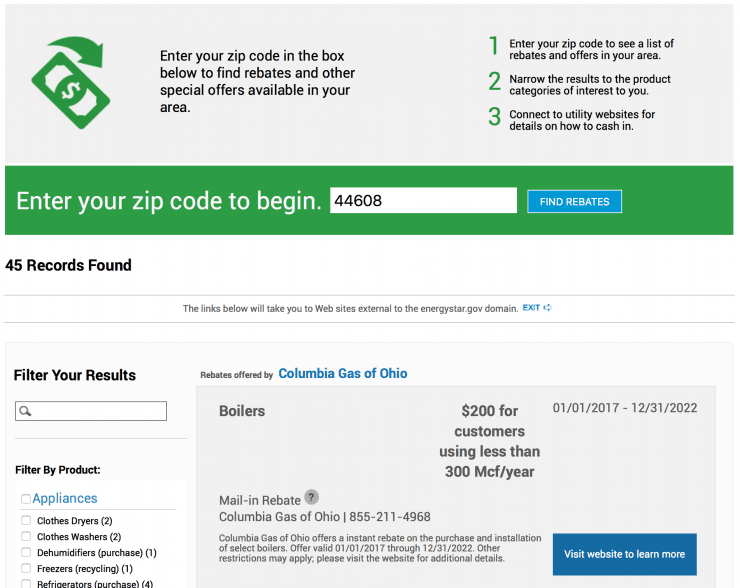

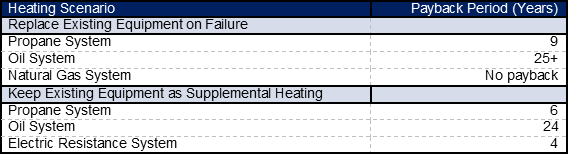

When upgrading your home to the latest energy efficient appliances and equipment many energy providers offer a variety of rebates for energy efficient products including rebates for washing machines water heaters and smart thermostats. In 2018 and 2019 an individual may claim a credit for 1 10 percent of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to the overall credit limit of 500. Find money saving rebates and incentives for your clients. If you prefer to have a licensed contractor install your new windows search our directory to find participating contractors.

Reflective attic barriers and siding are not eligible. Get your rebate in 4 to 6 weeks. Happier clients are better for your business. Film must be installed over single or double clear glass and must be located on the east and west elevation.

Residential home improvement rebate program rebate of 1 60 sf of window for energy star windows. Rebate of 0 40 sf of window film for energy star window film. Film must have a shgc of 0 50 or less. Through the 2020 tax year the federal government offers the nonbusiness energy property credit.

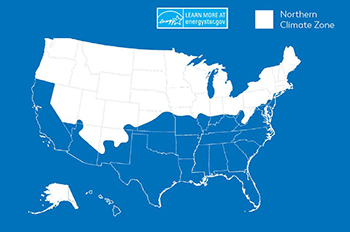

Windows are per unit and may include those rated as energy star for northern climate zone. For example energy efficient exterior windows and doors certain roofs and added insulation all qualify but costs associated with the installation weren t included. Includes sliding and swinging glass doors. 25 50 rebate on energy efficient washers.

Existing windows must clear glass. Help them boost their bottom line with rebates and incentives on the latest energy saving solutions for all types of residential projects. Claim the credits by filing form 5695 with your tax return. Here you ll find special offers on heating and cooling systems lighting upgrades energy saving appliances and more.

These contractors do not represent or work for dte. After you install new energy efficient insulation apply for your rebate. Tax credits for residential energy efficiency have now been extended retroactively through december 31 2020.