Equipment Lease Rates Canada

The 1 buyout lease a capital lease in which the lessee makes fixed payments each month and then has the right to purchase the leased equipment for 1 at the conclusion of the lease period.

Equipment lease rates canada. Financing manufacturing equipment is easy with hitachi capital canada corp. This opportunity rate is set at 1 5 per cent annually and. We offer equipment financing solutions to businesses across canada. Why heavy equipment leasing rates matter less than you think.

Advantages of equipment leasing for dealers. This annual borrowing rate is set at six per cent. Equipment priced less than 100 000 usually comes with a higher finance rate anywhere from 8 to 20. Equilease is an established lease financing company founded in toronto in 1991.

If you bought from a dealer at a 5 rate over 5 years your payment would be 1 400 a month. Average interest rate for equipment loans with a seven year payback. Looking for the right equipment and more financial flexibility. Unless rates are outrageous it makes very little difference what actual rate you pay for your equipment.

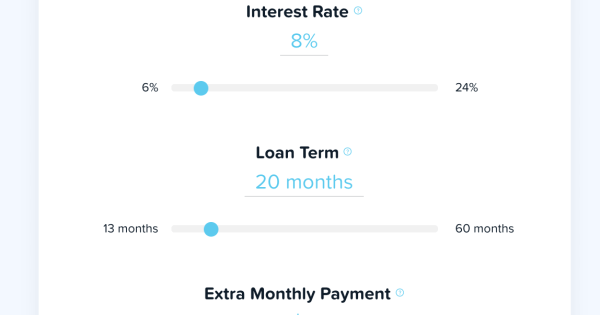

Estimate your lease payments and determine your total cost of borrowing with the equipment lease calculator. With our calculator you can choose from three of the most popular equipment lease types to calculate your payments. Your business needs are constantly changing and you need a financing partner that can evolve with you as you grow. The 80 20 of equipment leasing is driven by requests for leasing amounts of under 75 000 where the applicant has good credit has been in business for at least 3 years and has a commonly sold asset to lease.

A preferred financing method is leasing. Lease new or used equipment through hundreds of dealerships across canada. Take someone financing a trencher for 75 000. With pre approval from fcc you re good to go.

You can expect to see anywhere from high single digits to double digits so it makes sense to shop around before you commit. Most equipment leases come with a fixed interest rate and fixed term but interest rates and terms can vary depending upon the leasing company and your credit profile. Our financing solutions for manufacturing equipment have several advantages for dealers as well as for their clients. Equipment financing rates are determined based upon the size of the lease your credit score and payment history and where your business is located.

Free lease calculator to find the monthly payment or effective interest rate as well as interest cost of a lease.